Hire AI Agents for your AML Team

TL;DR

Bretton AI helps fintechs unlock growth with an AI compliance team.

Our workforce of AI agents tirelessly handle routine AML and KYC tasks, allowing your team to focus on higher-leverage work.

If you're a fintech or compliance leader, get in touch.

Problem

Fintech compliance teams spend millions of dollars on manual anti-money laundering (AML) and know-your-customer (KYC) reviews. To support customer growth, fintechs turn to outsourced analysts or consultants to complete these reviews. The workflows assigned to outsourced teams are routine, clearly-defined and require risk-based decisions to be escalated to a full-time employee (FTE).

Managing outsourced analysts is painful and expensive. Training takes months, quality assurance is a challenge and any additional tooling/automation needs to be built by your internal engineering teams.

Critically, the productivity of these AML teams are low. McKinsey estimated that as little as 15% of an AML investigator’s time is spent actually investigating. Manual processes, administrative tasks and limited working hours leave backlogs to grow, increasing risks of a major fine.

Solution

Bretton AI agents learn your alert review process and work 24/7 to complete entry-level KYC and AML tasks.

They pair language models and 200+ data sources to action false positives, investigate high-risk customers and create audit-ready narratives.

Suspicious activity is escalated to your FTEs, allowing you to be in control of risk based decisions.

Here's how it works

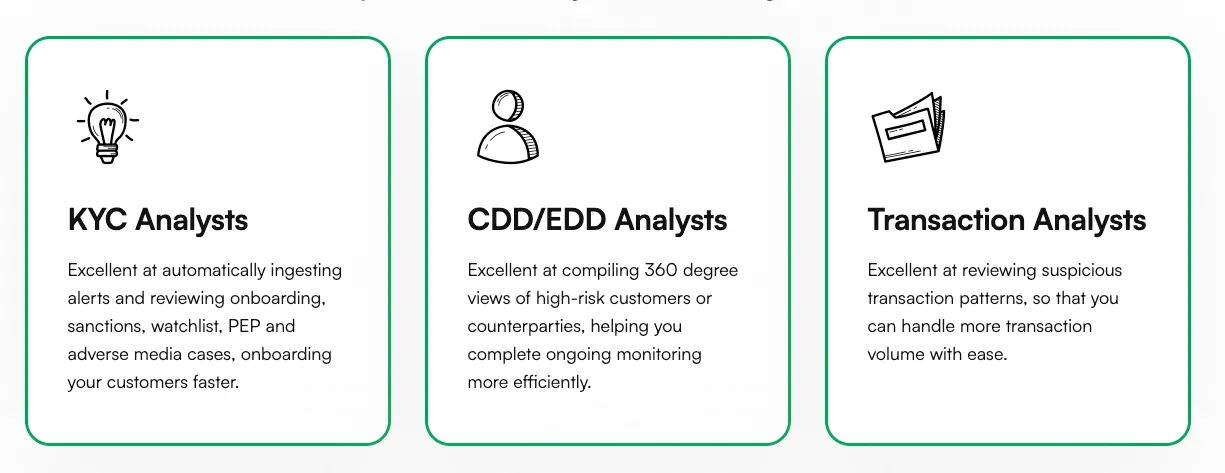

Choose where you need staff augmentation

Bretton supports three agent archetypes (with more to come). Each one can learn your company’s specific workflows to handle routine cases.

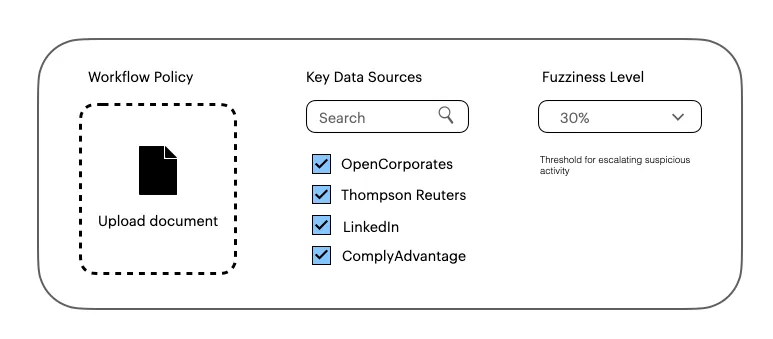

Add your policy, data sources and fuzziness thresholds

Upload your workflow policy, define the data sources that are needed for this job and determine the fuzziness threshold you’re comfortable with.

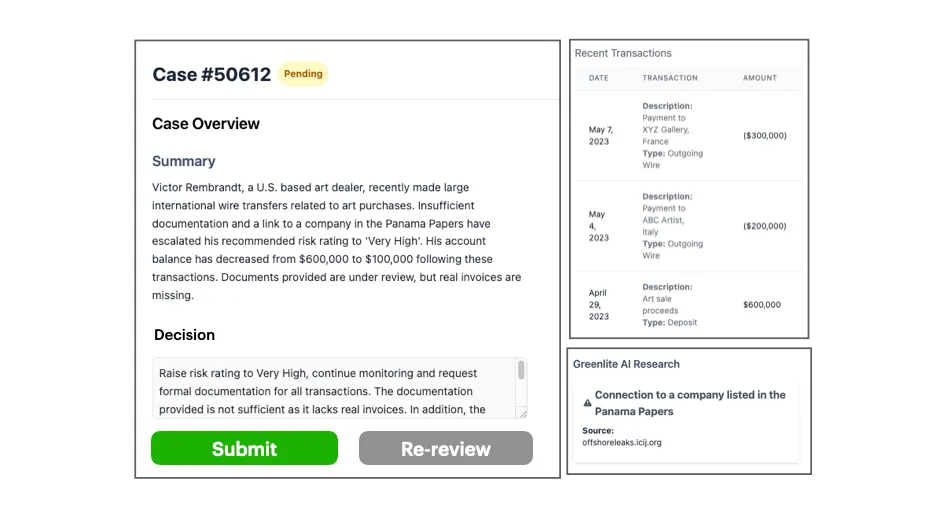

Review escalated cases

Agents will escalate cases that require a risk based decision. Importantly, your FTEs get an enriched case, complete with entity investigation details, data analysis and open-source intelligence to make high quality decisions more efficiently.

Schedule a demo here to see how Bretton can help you scale your compliance operations with AI instead of outsourced teams.

Benefits of Bretton AI:

- Higher quality, transparency and control of reviews: give your team better visibility and control of your AML operations.

- Dramatic savings: using automated systems instead of human-reviewers will unlock capacity for strategic priorities.

- Unblock growth: with near-instant compliance capacity, your team can focus on higher-priority initiatives, like license applications, complex investigations and scaling core systems.